A Beginner's Comprehensive Guide to Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) have become increasingly popular in recent years as a way for investors to gain exposure to a wide range of assets without having to buy and sell individual stocks or bonds. ETFs are a type of investment fund that tracks the performance of a specific index, sector, or commodity. They are traded on stock exchanges like stocks, but they offer a number of advantages over traditional mutual funds.

In this beginner's guide, we will provide you with an overview of ETFs, including how they work, the different types of ETFs available, and the benefits and risks of investing in ETFs. We will also provide you with some tips on how to choose the right ETFs for your investment portfolio.

ETFs are created by investment companies that pool together the money of investors and use it to buy a basket of assets. The assets in an ETF can be stocks, bonds, commodities, or other types of financial instruments. The investment company then issues shares in the ETF that represent ownership of a portion of the underlying assets.

4.1 out of 5

| Language | : | English |

| File size | : | 5001 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 83 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

The value of an ETF share is determined by the value of the underlying assets. When the value of the underlying assets goes up, the value of the ETF share will also go up. Conversely, when the value of the underlying assets goes down, the value of the ETF share will also go down.

ETFs are traded on stock exchanges like stocks, so you can buy and sell them throughout the trading day. This makes ETFs a very liquid investment, meaning that you can easily convert them into cash if you need to.

There are many different types of ETFs available, each with its own unique investment objective. Some of the most popular types of ETFs include:

- Index ETFs: These ETFs track the performance of a specific market index, such as the S&P 500 or the Nasdaq 100.

- Sector ETFs: These ETFs track the performance of a specific sector of the economy, such as technology or healthcare.

- Commodity ETFs: These ETFs track the performance of a specific commodity, such as gold or oil.

- Bond ETFs: These ETFs track the performance of a specific bond market index, such as the Bloomberg Barclays US Aggregate Bond Index.

- Currency ETFs: These ETFs track the performance of a specific currency, such as the US dollar or the euro.

- Inverse ETFs: These ETFs track the inverse of the performance of a specific index or asset. This means that when the value of the underlying asset goes up, the value of the inverse ETF will go down, and vice versa.

- Leveraged ETFs: These ETFs use leverage to magnify the returns of a specific index or asset. This means that leveraged ETFs can provide investors with the potential for higher returns, but they also come with greater risk.

There are a number of benefits to investing in ETFs, including:

- Diversification: ETFs provide investors with a way to diversify their portfolios across a wide range of assets. This can help to reduce risk and improve returns.

- Liquidity: ETFs are very liquid, meaning that you can easily buy and sell them throughout the trading day. This makes ETFs a good choice for investors who need to be able to access their money quickly.

- Low costs: ETFs typically have lower fees than other types of investment funds, such as mutual funds. This can save you money over time.

- Transparency: ETFs are very transparent, meaning that you can easily find out what assets are in the fund and how it is managed. This can help you to make informed investment decisions.

There are also some risks associated with investing in ETFs, including:

- Market risk: The value of ETFs can fluctuate with the market. This means that you could lose money if the market goes down.

- Tracking error: ETFs are not always able to perfectly track the performance of their underlying index or asset. This can result in tracking error, which can eat into your returns over time.

- Expense ratio: ETFs have an expense ratio that covers the costs of managing the fund. This expense ratio can reduce your returns over time.

- Leverage risk: Leveraged ETFs can magnify the returns of a specific index or asset. However, they also come with greater risk. This means that you could lose more money than you invested if the market goes down.

When choosing ETFs for your investment portfolio, it is important to consider the following factors:

- Investment goals: What are your investment goals? Are you looking for growth, income, or both?

- Risk tolerance: How much risk are you willing to take?

- Time horizon: How long do you plan to invest for?

- Investment amount: How much money do you have to invest?

Once you have considered these factors, you can start to narrow down your choices. You can use a screener tool to find ETFs that meet your specific criteria. You can also consult with a financial advisor to get help choosing the right ETFs for your portfolio.

ETFs are a versatile investment tool that can be used to meet a variety of investment goals. They offer a number of benefits over traditional mutual funds, including diversification, liquidity, low costs, and transparency. However, it is important to understand the risks associated with ETFs before investing. By carefully considering your investment goals, risk tolerance, time horizon, and investment amount, you can choose the right ETFs for your portfolio.

4.1 out of 5

| Language | : | English |

| File size | : | 5001 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 83 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Jeremy Taylor

Jeremy Taylor Vince Flynn

Vince Flynn Bobbi Conner

Bobbi Conner Peter Reinhart

Peter Reinhart Cormac Mccarthy

Cormac Mccarthy Sheila Scobba Banning

Sheila Scobba Banning Bradley Stone

Bradley Stone Nicoline Ambe

Nicoline Ambe Rachel Holtzman

Rachel Holtzman K G Lewis

K G Lewis Kamalia Hasni

Kamalia Hasni Peter Clarke

Peter Clarke Annette Leibing

Annette Leibing Jeff Thomas

Jeff Thomas Jim Belmessieri

Jim Belmessieri Steven J Taylor

Steven J Taylor Benjamin Corman

Benjamin Corman Scott Reynolds Nelson

Scott Reynolds Nelson Albert Einstein

Albert Einstein Revised Edition Kindle Edition

Revised Edition Kindle Edition

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Clark CampbellHigh Performance Street Riding Techniques 2nd Edition: Unleash Your Inner...

Clark CampbellHigh Performance Street Riding Techniques 2nd Edition: Unleash Your Inner...

Chuck MitchellUnveiling the Secrets of the Atlantean Artifact: A Journey into the Harvey...

Chuck MitchellUnveiling the Secrets of the Atlantean Artifact: A Journey into the Harvey...

Herbert CoxSelected Poems and Songs: Oxford World Classics - A Comprehensive Analysis of...

Herbert CoxSelected Poems and Songs: Oxford World Classics - A Comprehensive Analysis of...

Galen PowellThe Life of Marcus Aurelius Antoninus: With Biographical Sketch And Notes By...

Galen PowellThe Life of Marcus Aurelius Antoninus: With Biographical Sketch And Notes By... Bruce SnyderFollow ·18.7k

Bruce SnyderFollow ·18.7k Jason HayesFollow ·7.2k

Jason HayesFollow ·7.2k Paul ReedFollow ·2.2k

Paul ReedFollow ·2.2k Joseph ConradFollow ·13.3k

Joseph ConradFollow ·13.3k Chase SimmonsFollow ·19.9k

Chase SimmonsFollow ·19.9k Ismael HayesFollow ·4.1k

Ismael HayesFollow ·4.1k Herman MelvilleFollow ·18.4k

Herman MelvilleFollow ·18.4k Kyle PowellFollow ·10.8k

Kyle PowellFollow ·10.8k

Eugene Powell

Eugene PowellComplete Guide to Using Yoga With Kids: Benefits, Tips,...

Yoga is an ancient practice that has been...

Benji Powell

Benji PowellHow to Make $000 Per Week on Craigslist

Are you looking for a way to make extra money...

Gabriel Garcia Marquez

Gabriel Garcia MarquezGrocery Row Gardening: The Exciting New Permaculture...

Kick-start your gardening journey with the...

Hayden Mitchell

Hayden MitchellUnveiling the Gripping World of Winterwood: Ben Hood...

In the annals of crime thrillers, the...

E.M. Forster

E.M. ForsterThe Financial Advisor Guide To Managing and Investing...

As a financial...

Lee Simmons

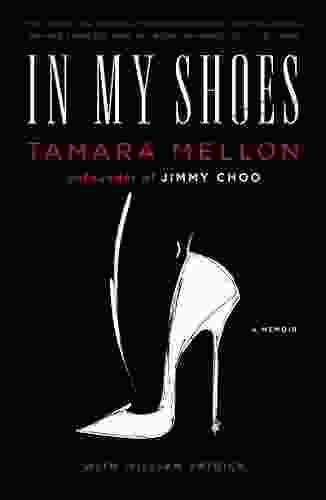

Lee SimmonsIn My Shoes Memoir: A Poignant Journey of Resilience,...

In the tapestry of life, adversity often...

4.1 out of 5

| Language | : | English |

| File size | : | 5001 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 83 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |